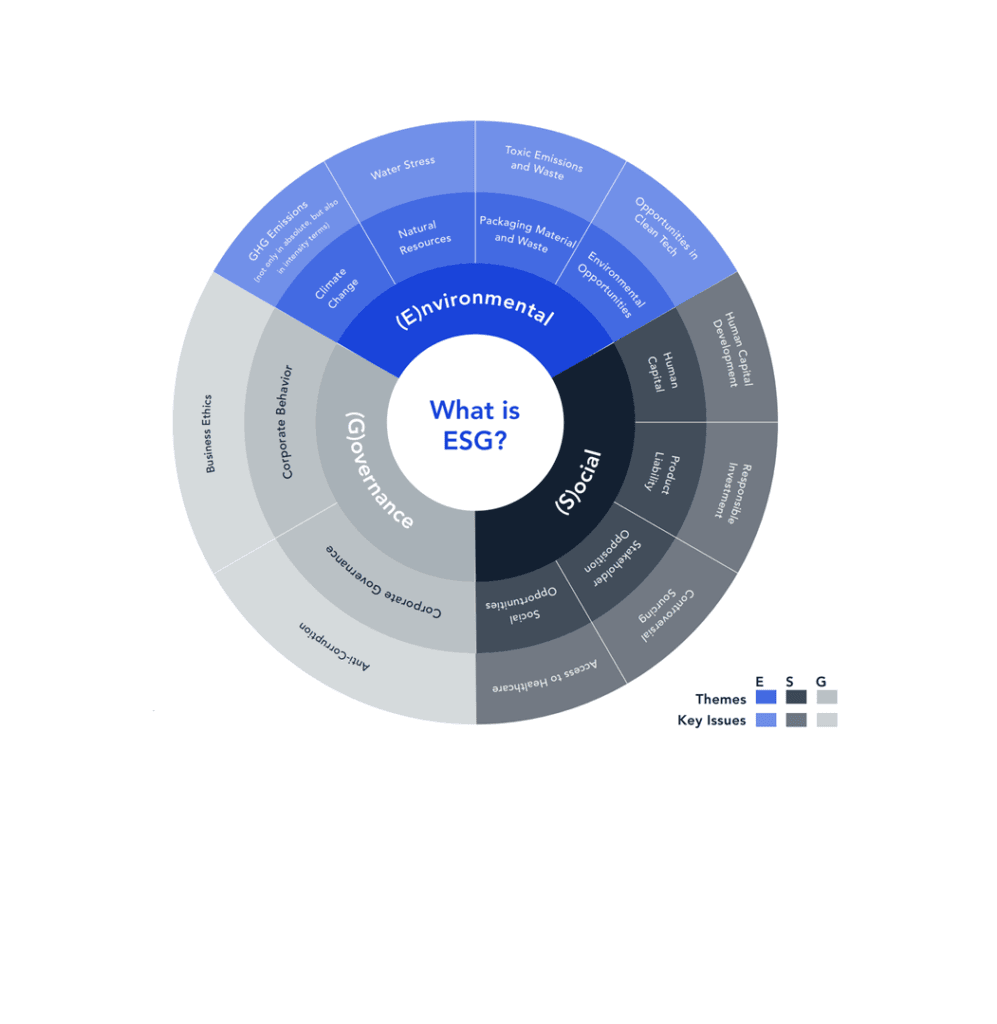

Saudi Arabia is committed to implementing sustainable development and attaches the highest priority to this endeavor, as commensurate with the Kingdom’s specific context and national principles. The Saudi Exchange issued Environmental, Social, and Governance (ESG) disclosure guidelines to promote sustainable growth in Saudi Arabia on October 28, 2021. The guidelines demonstrate Saudi Exchange’s continued commitment to support more than 200 listed companies and also prospective companies looking to list. These guidelines are intended to help companies listed on Saudi Exchange to: Increase awareness and understanding of what ESG is and why it is important.

Mr. Mohammed Al-Rumaih, CEO of the Saudi Exchange (Tadawul) said “”Publishing ESG disclosure guidelines marks a significant milestone in our efforts to provide a consistent approach to ESG reporting for all our listed companies.”

By the end of 2020, the United Nations-supported Principles for Responsible Investment (PRI) had over more than 3,000 signatories managing more than US $ 103 trillion. This is a significant improvement from 2010 when there were only 734 signatories with US $21 trillion.

In 2018, Saudi Exchange (formerly the Saudi Stock Exchange ‘Tadawul’) became a partner exchange supporting the UN Sustainable Stock Exchanges Initiative and working to promote ESG awareness, initiatives and encourage sustainable investment, in collaboration with market participants such as issuers and investors. Since then, Saudi Exchange has engaged with listed companies, standards-setters, index providers, ratings providers, investors, and other stock exchanges, through a myriad of mediums to help advance ESG disclosure in the Saudi capital market. The Exchange feels a responsibility to support the advancement of ESG in Saudi Arabia, and the wider region, and so it remains focused on raising awareness and encouraging listed companies to disclose ESG (Source: Saudi Exchange, Tadawul Group).

These guidelines have been created as a useful resource for listed companies to help them navigate ESG. This is important as ESG is an ever-changing landscape; as it advances and the Saudi capital market continue to develop, an updated version will be issued. The intention is to ensure the guidelines remain relevant and can continue to act as a catalyst supporting the sustainable and inclusive growth of the Saudi capital market, for the benefit of all market participants.

Source: ESG Disclosure Guidelines – Saudi Arabia, 2021, p. 8

These are some of the ministries, authorities and foundations that are shaping the sustainability agenda in Saudi Arabia, in line with Vision 2030:

ESG Disclosure Guidelines – Saudi Arabia

You can download here

Source: Saudi Exchange, Tadawul Group